The IEEE Region 10 Humanitarian Technology Conference (HTC) 2025 was carried out at Chiba University of Commerce, Japan, from 28 September to 1 October, bringing together global visionaries under the theme “Beyond SDGs, A New Humanitarian Era with Intelligent Partners.” The conference highlighted the synergy between human intellect and emerging intelligent systems in advancing humanitarian impact through technology.

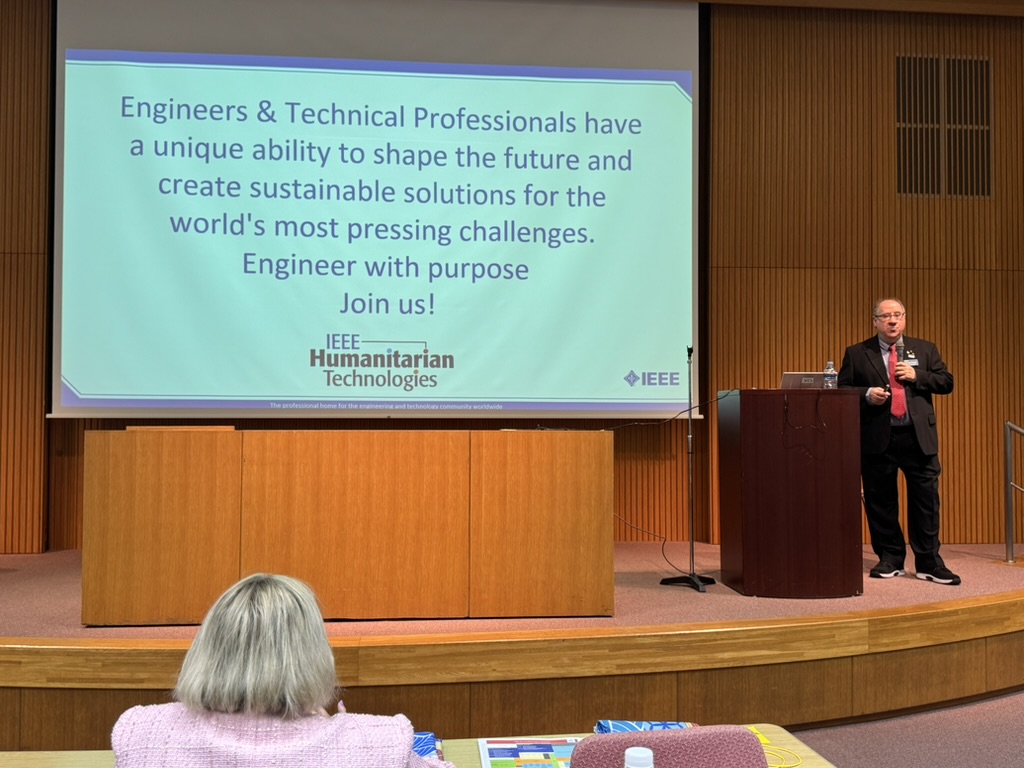

During the Opening Ceremony, Grayson Randall, President of the IEEE Humanitarian Technologies Board (HTB), delivered an address emphasising the special position of the engineering profession in improving and enhancing the quality of life. His message underscored that engineers are not merely problem-solvers but architects of hope, capable of bridging innovation with social responsibility. He further presented new opportunities within HT programmes to stimulate inclusive and impactful projects across the Asia-Pacific region. On the second day, IEEE President-Elect Mary Ellen Randall presented a visionary keynote speech outlining IEEE’s roadmap for advancing the engineering profession in alignment with global human development goals. She articulated how IEEE’s strategic directions, from digital ethics to sustainable innovation, converge towards one essential mission, the enhancement of human life quality through intelligent collaboration.

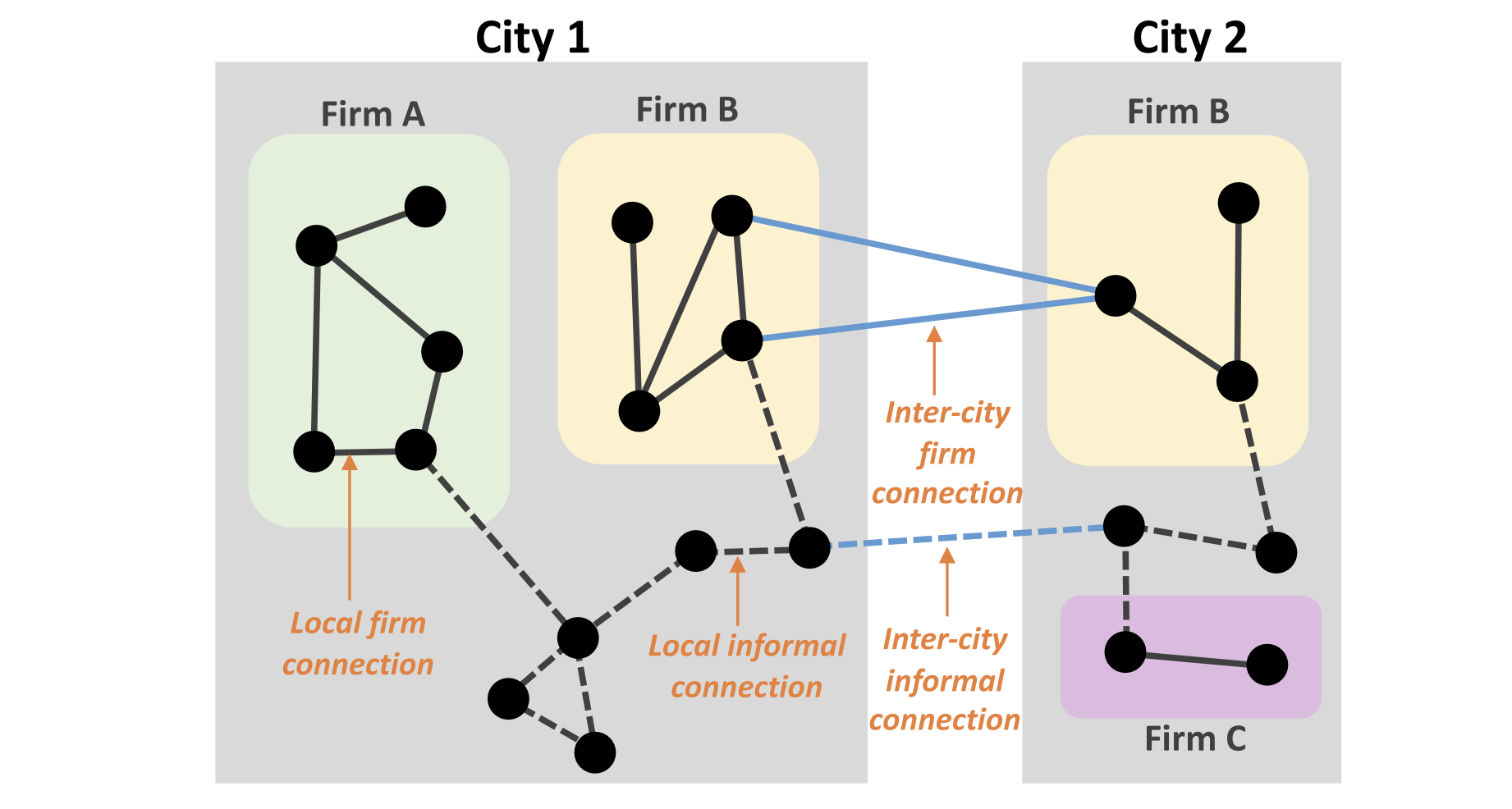

On Day 3 (1 October), I delivered my presentation in Special Program 15, titled “Synergy for Sustainable Impact.” The session, moderated by Allya Paramitha, brought together distinguished panellists Hidenobu Harasaki, Husain Mahdi, Agnes Irwanti, Bernard Lim, Chie Sato, Saurabh Soni, and your truly. The discussion explored collaborative mechanisms between technology, policy, and social innovation to accelerate humanitarian outcomes through sustainable synergy. I often begin my presentations on synergy, ecosystems, and industry collaboration by framing them within the principles of complexity theory, illustrating how synergies can generate emergent, non-linear value in complex socio-technical ecosystems. These emergences are the key to the transformations central to achieving the UN Sustainable Development Goals (SDGs), particularly in fostering inclusivity, resilience, and equity.

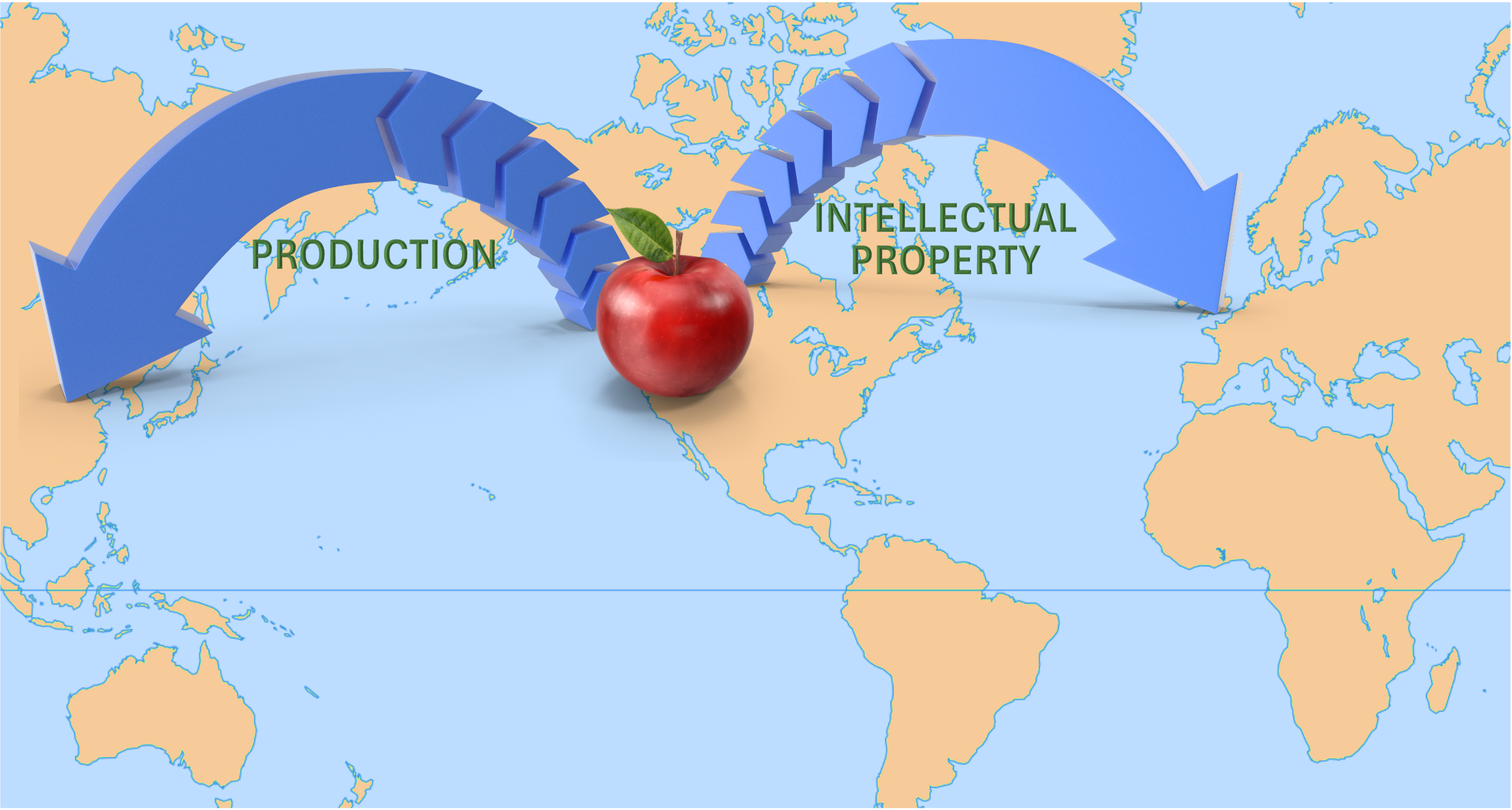

Drawing from Indonesia’s national vision, I illustrated how the MSME commerce ecosystem has become a model of humanitarian technology application in real-world contexts. Through programmes focusing on microfinance, digital platforms, and cooperative empowerment, the framework demonstrated how technology can elevate non-consumption markets into productive and sustainable systems. I also shared case studies in which IEEE Indonesia SIGHT in Sociopreneurship and Sustainability provides capability building for IEEE Indonesia Student Branches, each designing local solutions including solar-powered water systems, IoT monitoring, and sociopreneurship incubation, as currently being undertaken by Gadjah Mada University and Udayana University. These projects exemplify how engineering-led engagements can evolve into community-driven sociopreneurship, ensuring sustainability through ownership, replication, and measurable impact.

On Day 0 (28 September), I provided a briefing on these programmes to IEEE President-Elect Mary Ellen Randall and HTB President Grayson Randall. These exchanges laid the groundwork for advancing IEEE humanitarian initiatives in Indonesia and the Asia-Pacific region, focusing on digital ecosystems, sociopreneurship, and sustainable innovation models. I also discussed these programmes during Special Program 13 (30 September), “From Innovation to Impact: Advancing IEEE Humanitarian Initiatives”, where I joined the HTA Forum to discuss strategic alignment between IEEE humanitarian frameworks and regional ecosystem development.

The IEEE R10 HTC 2025 stood out not only as a conference of ideas but as a living demonstration of synergy, the fusion of intellect, empathy, and technology. The conference reaffirmed a timeless truth, engineering is not merely about machines or systems, but about humanity itself. The IEEE R10 HTC 2025 thus marked another milestone in the collective journey to build a more equitable, resilient, and sustainable world, powered by both human insight and intelligent innovation.